Key Benefits of Group Vision Insurance Explained

Employer Group Vision Insurance: What It Is and Why It Matters

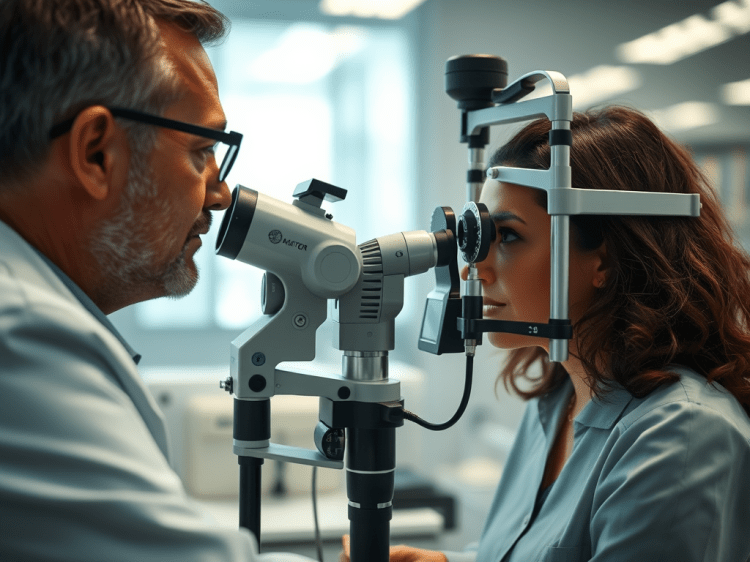

Employer group vision insurance is a benefit that many companies offer to help employees pay for vision-related expenses. These expenses include eye exams, prescription glasses, contact lenses, and even corrective surgeries like LASIK. It’s part of the overall benefits package an employer provides. It can be a valuable addition, especially for those who need regular eye care.

Here’s how it works: Employees won’t pay full price for vision services on their own. The company arranges a group plan with an insurance provider. The plan covers multiple employees. As a result, it usually comes with lower premiums. It also offers better rates compared to individual vision insurance plans. This means employees often pay a small monthly amount. Employers may cover this, or it is deducted from their paycheck. They receive coverage on vision-related costs.

Key Benefits of Group Vision Insurance

- Cost Savings

One of the most significant advantages of group vision insurance is the financial savings it offers. Eye exams, glasses, and contact lenses can add up quickly, especially for families. With vision insurance, employees pay much less out-of-pocket for these services. Many plans will cover annual eye exams at no cost or with just a small copay. Discounts on frames, lenses, and contact lenses are also common, sometimes cutting costs by 30% or more. - Preventive Care

Regular eye exams are about more than just updating your prescription. Eye doctors use them to catch early signs of serious health conditions. These can include glaucoma, cataracts, or even diabetes. Having access to affordable vision care means employees are more likely to get these exams regularly. This access can lead to early detection and treatment of potential issues. - Convenience

With group vision insurance, employees can easily access a network of eye care providers. This network often includes a wide range of optometrists and ophthalmologists. Retail chains are also part of it. This makes it simple to find a provider nearby. Some plans also offer flexibility, allowing employees to visit out-of-network providers for a slightly higher cost. - Better Productivity and Quality of Life

Vision problems can affect job performance and overall quality of life. Struggling to see clearly can lead to headaches, eye strain, and fatigue, which impact productivity. With vision insurance, employees are more likely to address these issues quickly, improving both their work performance and day-to-day life.

In summary, employer group vision insurance is a smart way to make vision care more affordable and accessible. It provides cost savings, encourages preventive care, and ultimately contributes to better health and productivity.