Why You Need Disability Insurance for Financial Security

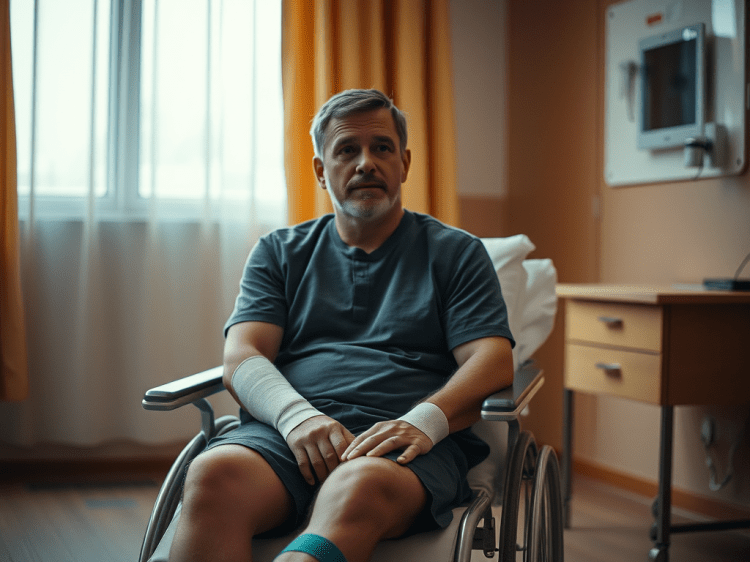

Understanding Disability Insurance: Protecting Your Income and Future

Disability insurance ensures you receive financial support if you cannot work. This protection applies when illness or injury interrupts your work. This safety net is vital for people who depend on their income for daily expenses. These expenses include rent, groceries, and medical bills. While many people think about health insurance, disability insurance focuses specifically on protecting your ability to earn a living.

There are two main types of disability insurance: short-term and long-term. Short-term disability insurance typically covers a portion of your salary for a limited period, usually up to six months. Long-term disability insurance starts after short-term coverage ends. It can provide benefits for several years. Some policies offer benefits until retirement age, depending on the policy.

One of the primary benefits of having disability insurance is peace of mind. Knowing that you have a financial cushion can relieve stress if you face unexpected health challenges. It can help you maintain your quality of life and prevent financial hardship during tough times.

Additionally, disability insurance can cover a significant portion of your lost income, usually around 60-80%. This means you can focus on recovery rather than worrying about bills piling up. It can also help cover expenses related to medical care, rehabilitation, and any necessary adjustments to your home or vehicle.

In summary, disability insurance is an essential protection for anyone who wants to secure their financial future. By investing in this type of coverage, you’re protecting your income. You’re also safeguarding your overall well-being. It helps protect the well-being of your loved ones too.